RFS and the Push for Greater Ethanol Content in Gasoline

Despite falling short of its statutory goals, the Renewable Fuel Standard (RFS) remains the most significant federal program supporting the biofuel industry and has had a consequential impact on gasoline marketers. Established by the Energy Policy Act of 2005 and expanded in 2007 by the Energy Independence and Security Act (EISA), the RFS states the annual targets for the volume of renewable fuel that must be consumed in lieu of petroleum-based transportation fuel, known as a Renewable Volume Obligation (RVO).

As administrator of the RFS, the Environmental Protection Agency (EPA) has the authority to adjust the RVO, which is proposed as a volume of renewable fuel and as a percentage of how much petroleum-based fuel would be offset. Traditional corn-based ethanol, simply referred to as a renewable fuel by the RFS program, accounts for most of the renewable fuel consumed as a road transportation fuel in the United States. The other nested categories include cellulosic biofuel, biomass-based diesel, and advanced biofuel.

Once triggered, EPA can modify statutory volumes based upon six factors, while doing so in coordination with the secretaries of energy and agriculture.

Owing to insufficient production, EPA has had to frequently issue waivers for the cellulosic biofuel nested category. However, EPA’s 2019 final rule pegged volume requirements below statute for total renewable fuel, triggering the agency’s reset authority under the RFS. Once triggered, EPA can modify statutory volumes based upon six factors, while doing so in coordination with the secretaries of energy and agriculture. Those six factors are: (1) environmental impact; (2) energy security; (3) annual production rate of renewable fuels; (4) impact on infrastructure, including the sufficiency of infrastructure to deliver and use renewable fuel; (5) cost to consumers; and (6) other factors, such as job creation, price and supply of agricultural commodities, rural development, and food prices.

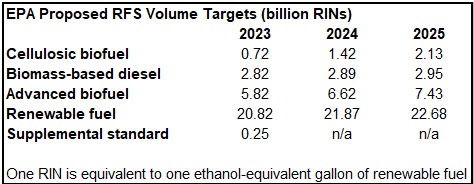

2023 is the first year EISA does not specify volume requirements for the RFS. Instead, EPA proposed a set rule establishing the annual RVO. On December 1, 2022, EPA proposed volume requirements for 2023 through 2025, and a public comment period on the proposal ended on February 10. The final rule should be announced no later than June 14, based on the terms of a consent agreement between the ethanol trade group Growth Energy and the EPA. EPA’s checkered history in meeting deadlines under the RFS program prompted Growth Energy to seek the consent decree with the U.S. District Court for the District of Columbia.

Proposed Renewable Fuel Standard volume targets through 2025.

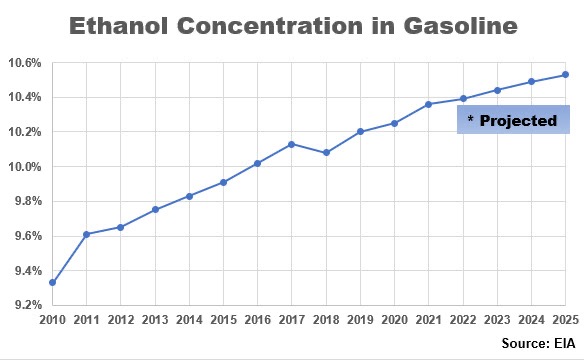

In a review of expectations for increased ethanol consumption for this year through 2025, the Energy Information Administration offers a conservative projection, pointing to limitations in how fast retailers would invest, if at all, in their stations to allow for higher blends. Historically, pushing above the 10% ethanol blend rate in gasoline has been stymied by fuel volatility standards that are the most restrictive during the summer months, when increased ambient temperatures accelerate the release of volatile organic compounds into the atmosphere. Ethanol adds to fuel volatility. While E10 has a one-pound-per-square inch waiver to offset this volatility (measured as a Reid Vapor Pressure rating), E15 currently does not, precluding conventional gasoline sales above E10 during the summer season, from June 1 through September 15.

Ethanol concentrations in U.S. gasoline from 2010 to 2025, including future projections.

The inability for most retail outlets to offer E15 during the summer season has restricted their expansion.

The inability for most retail outlets to offer E15 during the summer season has restricted their expansion. Ethanol’s concentration in the U.S. gasoline pool has hovered above 10% since 2016 — but just barely, estimated at 10.39% in 2022. There are more E85 stations than E15 stations, with consumers of E85 requiring a flex-fuel vehicle (FFV) designed to handle fuel with a greater concentration of ethanol than gasoline. For 2021, EPA determined there were 2,458 E15 stations and 4,063 E85 stations, representing less than 5% of the more than 145,000 gas stations in the United States, according to NACS. In a draft regulatory impact analysis, EPA projects the number of E15 stations to top E85 stations at 5,146 to 4,866 in 2025.

The number of light-duty FFVs, which totaled about 28 million in 2020 (roughly 10% of all spark-ignition vehicles), is expected to decline with fewer models available. The total number of FFV model offerings has declined since 2014, with the annual increase in light-duty FFV registrations falling from 10% in 2017 to 1.6% in 2020.

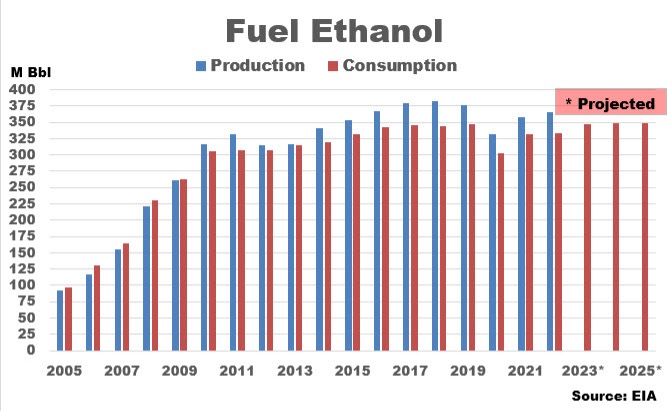

EPA projects slow growth in ethanol consumption from 2023 through 2025.

In determining estimated costs of the RFS, EPA projects slow growth in ethanol consumption from 2023 through 2025, projecting a year-on-year increase for 2023 at 14.5 million barrels or 4.35% to 347.4 million bbl which trails off to annual growth of 700,000 bbl or 0.2% in 2025 for consumption of 349.3 million bbl. For greater ethanol concentration in the gasoline pool, there needs to be investment at retail stations that make those outlets compatible to sell E15. As EPA notes in its analysis, stations with the capability to sell higher ethanol blends already have the infrastructure in place. Investment costs by retailers to sell higher ethanol blends could vary from a few thousand dollars to more than $100,000 per station.

U.S. ethanol production and consumption from 2005 to 2025, including future projections.

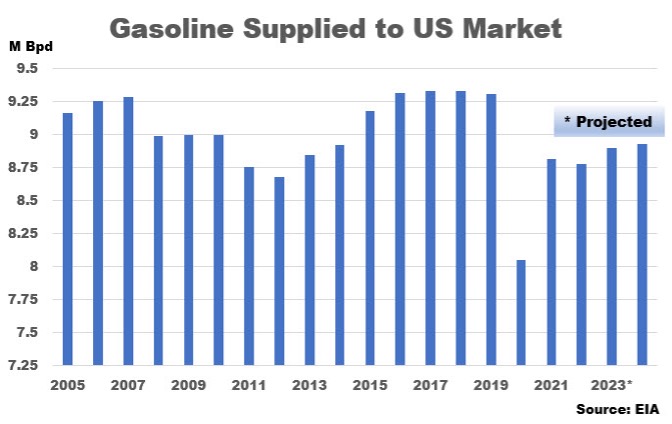

Gasoline supplied to the U.S. market from 2005 to 2024, including future projections.

In their research, and in consulting the EPA’s Office of Underground Storage Tanks, the agency estimates a typical retail station upgrade to sell E15 would cost $80,000 in assuming four new dispensers, with additional investment of $15,000 for additional equipment changes, such as pipes, pumps, and the hardware associated with underground storage tanks.

Liability concerns also have the potential to slow the expansion of higher-blend outlets, with concerns centering over the use of retail storage and dispensing equipment. Even if compatible, the equipment is required to be approved to store or dispense E15. A retailer might incur liability if a consumer refuels a vehicle in which the engine is not designed or approved for the higher blend.

Under EPA regulations, retailers storing gasoline with an ethanol concentration greater than 10% in underground tanks must demonstrate compatibility of their tanks by a certification or listing that the equipment is nationally recognized by an independent testing laboratory or have written approval by the equipment or component manufacturer.

“The use of any equipment to offer E15 that does not satisfy these requirements, even if that equipment is technically compatible with E15, would pose potential liability for the retailer,” said EPA.

The agency sees an opportunity for retailers to install new systems with the compatibility to store E15 when their existing storage tank systems are at the end of their warranty or need a repair or upgrade.

“In sum, the relatively small, albeit growing, number of stations offering E15 represents a significant constraint on the expansion of E15 through 2025,” said EPA.

On March 14, a bipartisan group of U.S. senators and members of the House of Representatives reintroduced the Consumer and Fuel Retailer Choice Act of 2023 that amends the Clean Air Act to allow the 1psi RVP waiver for E15 by inserting “or more” after “10%.”

“Originally introduced late in the last congressional session, the Consumer and Fuel Retailer Choice Act would harmonize fuel volatility regulations for ethanol-blended fuels across the country, allowing for the year-round sale of E15 in conventional gasoline markets,” said the Renewable Fuel Association in welcoming the legislation.

RFA notes, too, that if passed, the legislation would supersede an effort by Midwest state governors to make regulatory changes to assure the availability of E15 sales year-round in their states. On March 1, EPA announced a proposal granting eight Midwestern states their petitions to reject the 1psi RVP vapor pressure waiver for E10, which would require oil refineries to adjust their baseline gasoline to accommodate ethanol without a waiver. Those states include Illinois, Iowa, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin.

While EPA called the effort “a permanent solution to provide year-round E15 in those states,” American Fuel and Petrochemical Manufacturers (AFPM) slammed the measure, indicating it would create a “new regional boutique fuel with lower RVP.”

“A boutique fuel for only these midwestern states is going to be significantly more complicated and expensive to produce and will require major adjustments to the refineries and fuel supply chain infrastructure serving the Midwest,” said AFPM, who hired consultants at Baker and O’Brien to study the issue. They found that a new gasoline blend for these eight states would come with annual costs between $550 and $800 million, while a supply disruption could push annual costs to $1.1 billion.

Partly due to AFPM’s effort, EPA delayed the effective date of its Midwest proposal until April 28, 2024.

For more refined fuels market analysis, visit DTN Energy Insights.

About the author

Brian L. Milne

Brian L. Milne is a 28-year veteran of the energy industry, and served in multiple roles at DTN, including editor and analyst. Milne delivered dozens of presentations on a wide range of topics discussing the energy markets and has been quoted widely in the media, including the Wall Street Journal, Barron’s, USA Today, Newsweek, CNN, National Public Radio, and major regional news outlets. He has authored numerous articles for international magazines, exploring market dynamics and providing forward-thinking commentary and analysis. Milne graduated from Monmouth University in New Jersey with a Bachelor of Arts in history and an interdisciplinary in political science (magna cum laude).

Comprehensive weather insights help safeguard your operations and drive confident decisions to make everyday mining operations as safe and efficient as possible.

Comprehensive weather insights help safeguard your operations and drive confident decisions to make everyday mining operations as safe and efficient as possible.