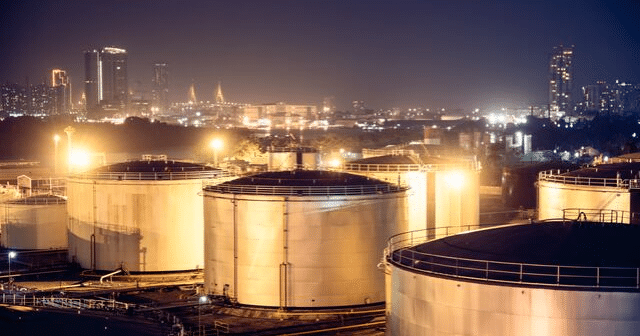

Demand product forecasting should require less guesswork to make it work for your operation. Leverage your existing data with DTN TABS Forecasting to drive optimal supply decisions.

DTN TABS® forecasting video

Demand product forecasting should require less guesswork to make it work for your operation. Leverage your existing data with DTN TABS Forecasting to drive optimal supply decisions.

Saudi Arabia will have fully restored the 5.7 million bpd in crude production shut-in by Saturday’s unprecedented attack on the Kingdom’s energy infrastructure and achieve 11 million bpd in output capacity by the end of September.

A lot of propane could be needed for crop drying this year because the total area in the Corn Belt that could require it is substantial.

Mild weather is giving the 2019 corn crop a chance to make it to the finish line, supported by satellite-data yield models.

Oil prices are strongly 8 to 10 percent higher in the wake of the weekend drone attacks on the Saudi Arabia oil operations.

The new oil markets trading week could emerge with a very volatile pattern after the attack on Saudi Arabia’s oil operations.

A drone strike on Saudi Arabian oil fields has the potential to push oil prices strongly higher, have a negative impact on global equity prices, send gold prices higher and likely push the U.S. dollar higher versus most currency pairs.

Stop by booth #US7394 to see how you can add the latest polyethylene and polypropylene data from CDI to DTN ProphetX.®

DTN Institute is proud to announce the launch of our new on-demand learning platform. Check out our latest class offerings. Use code TRY50 to get 50% discount off your first course through Sept 30.

Trading of liquefied natural gas products will begin Oct. 14, provided regulatory review clears the contract.